Contents

Financial reports, also known as financial statements or finance reports hold pivotal data that helps business owners make important decisions. Apart from business owners, creditors, shareholders, and market analysts also rely on information contained within financial reports to assess the financial performance of a business.

Every successful business owner must learn what information should be included into their financial reports and how data presented can be interpreted in order to contribute towards formulating effective business strategies. But this is not all there is to it.

Financial statements are also vital records that a business submits to the Inland Revenue Board of Malaysia (IRBM) or the Companies Commission of Malaysia (CCM) for income tax calculation and to declare their financial performance for each financial year.

What is a financial report?

A financial report is a formal record of a business’ financial activities and performance over the course of a selected period of time e.g. monthly, quarterly, or yearly. It is information that is generated after raw financial data from every business-related activity is processed and restructured into an easy-to-read format. As such, it becomes an important management tool that is used to communicate key financial information to various stakeholders.

By analysing KPIs within a financial report, a business owner, creditor, shareholder or market analyst, can get an overview of the business’ financial health and its earning potential.

For a business owner, knowing the financial performance of their business allows them to develop strategies aimed to boost sales or optimise operating cost. For an investor, having transparent access to view financial performance of a company allows them to properly assess whether the company is worth investing in. As for a creditor, having knowledge of a business’ financial position will help them decide if they should provide credit to a business.

Acknowledging the importance of financial reports, Biztory cloud accounting software was developed with an aim to equip business owners with fingertip access to accurate financial reports. By leveraging on the powers of technology, bookkeeping is now fully automated and financial reports can be created without consuming too much of a business owner’s time and resources.

Experience the power of financial reporting automation. Claim a free 30-day trial of Biztory cloud accounting software today!

Types of financial reports or financial statements

There are three core financial statements that are used to evaluate any business. These financial statements are also key financial instruments used to disclose a business entity’s financial activity every year, in line with the Malaysian Financial Reporting Standard (MFRS).

1. Statement of Financial Position (Balance Sheet)|

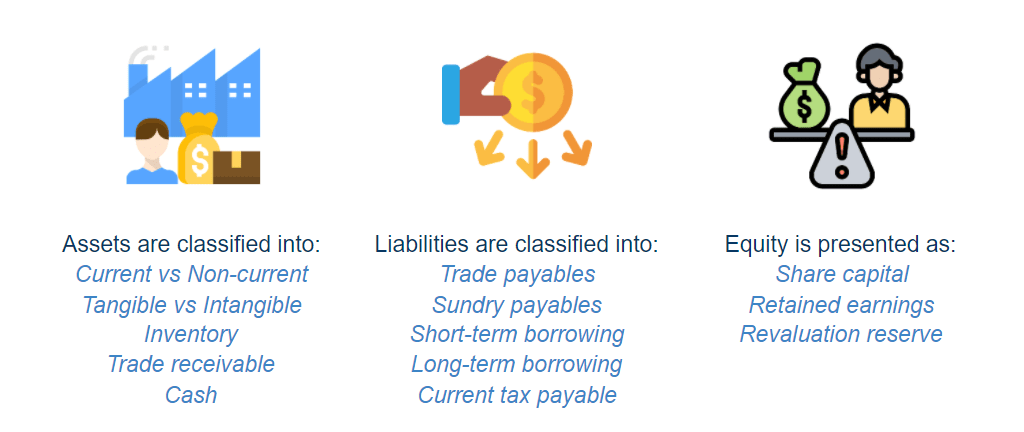

Statement of financial position is what is commonly known as the balance sheet. A balance sheet reports details of a business’ assets (what a business owns), liabilities (what a business owes), and equity (assets minus liabilities) at any specific time.

2. Profit and Loss Statement or Statement of Comprehensive Income

Profit and loss statement, also known as income statement, shows income from sale of goods or services, and business expenses. As the name indicates, it provides details of a business’ net profit or loss over a period of time.

Statement of comprehensive income is a statement that is usually used by large companies with businesses in multiple countries. This statement includes profit and loss statement with the addition of other comprehensive income that is not included in the profit and loss statement. Other comprehensive income are gains or losses that have not been realised such as the drop in value of foreign currency held by a company.

3. Cash Flow Statement

Cash flow statement shows movement of cash and bank balances of a business over a period of time. The movement of cash flows are affected by activities within a business such as its operating activities (cash flow from business-related activities), investing activities (cash flow from purchase and sale of non-inventory assets), and financing activities (repaying share capital and debt, or interest/dividend payment).

Even though these three are the core financial statements used to evaluate a business, there are various other forms of reports that can be prepared by a company to suit the monitoring of KPIs on a daily, weekly, or monthly basis which may contain more KPI-specific details.

On top of the core financial statements, Biztory enables generation of creditors’ aging report to track overdue payment to creditors and debtors’ aging report to track payments that have not been collected from debtors.

What should be included in a financial report?

Before you input data into a financial report or a financial statement, you must first know what type of financial report you are preparing. Are you preparing the balance sheet, profit and loss statement or cash flow statement?

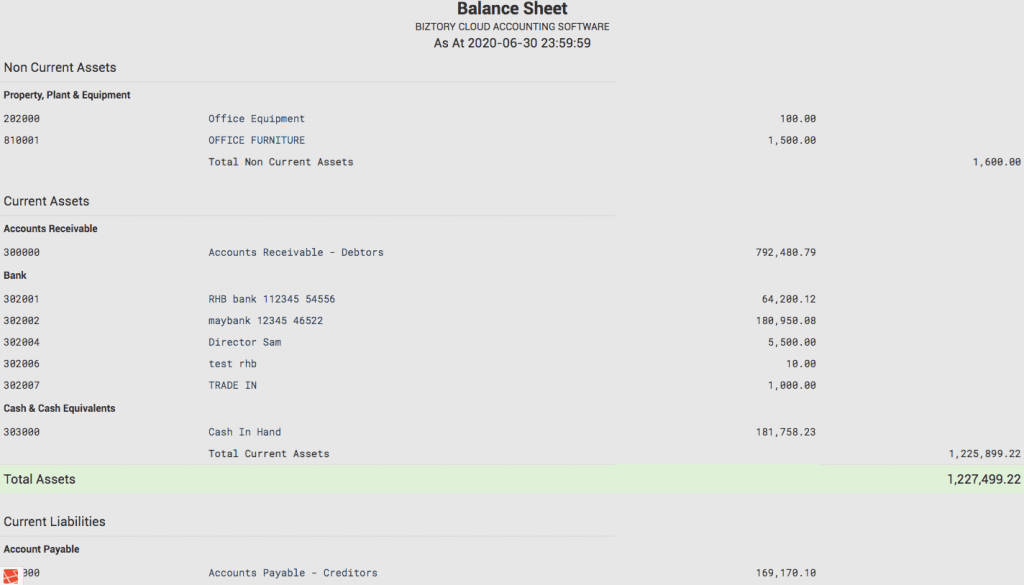

If you are preparing a balance sheet, information that needs to be included in this report are:

| Assets | Liabilities | Equity |

| What the business owns Example: Cash, inventory, plant, machinery | What the business owes Example: Creditors, bank loans | Assets – Liabilities |

Image Source: Flaticon

When you prepare a profit and loss statement, you will need to incorporate these information:

| Revenue | Income earned from principal activity Example: Income received by a clothing retailer from sale of clothing |

| Cost of sales | For retailers: Sum of opening inventory and new inventory, minus closing inventory for the year (For manufacturers: To include production cost incurred during production of goods) |

| Other income | Income earned from activities not related to main business Example: Interests earned from bank deposits |

| Distribution cost | Expenses incurred to distribute goods to customers |

| Administrative expenses | Expenses related to management and support function Example: Office rental, salary for senior management |

| Other expenses | Expenses that are not classified in any of the above |

| Finance Charges | Interest expense on loan |

| Income tax | Income tax expenses |

As for the cash flow statement, you will need to take into account your cash in hand, cash in bank, short term investments and bank overdrafts from the activities below:

| Operating Activities | Investing Activities | Financing Activities |

| Core business activities Example: Cash inflow for computer manufacturer from computer sales | Sales and purchase of non-core assets Example: Cashinflow from sale of factory | Example: Cash outflow due to dividend payout or interest expense |

How do you prepare a financial report?

What has been predominantly practiced in the business world is for financial reports to be prepared by an accountant, or someone with sound accounting knowledge. Since financial reports give an overview of a business’ financial health, you do not want your business’ book-keeping to be recorded or reflected wrongly.

Concerned business owners, who happen to be accountants, will usually do the business’ book-keeping when they are just starting out. This not only saves additional staff cost but also gives them a peace of mind and first-hand information whenever they wish.

Business owners who do not have accounting knowledge will have to set aside additional staff cost for the hiring of an accountant to ensure their business’ financial affairs are properly recorded. This is important to make certain that a correct financial report is provided for business monitoring and tax filing purposes.

But what happens if you are a small business owner who cannot afford an accountant?

And what if you are doubling up as an accountant, but find that you can’t properly focus on your business expansion because you just can’t trust the business accounting to another person?

Not to worry, keep reading as Biztory has just the right solution for you.

Biztory financial report generation

Now that the world has entered Industry 4.0, businesses are encouraged to move towards digital transformation. As if in support of this digital transformation, the COVID-19 pandemic has become a cruel catalyst to push businesses towards going digital instead of remaining complacent with the traditional way of doing business.

With digital transformation in mind, Biztory cloud accounting software aims to provide a holistic cloud accounting solution to all types of business owners by incorporating technology and automation in everyday business. After receiving feedback from business owners over the past number of years about their financial accounting woes, we began developing an app that will automate business book-keeping and allow business owners more time to focus solely on their business activities, while providing real-time financial overview at a touch of their fingertips.

Business owners who are concerned about accurate generation of financial reports can rest easy as they let the Biztory app automate their entire business’ book-keeping process and generate various financial reports at one click or touch.

Biztory Balance Sheet

Biztory Profit and Loss Statement

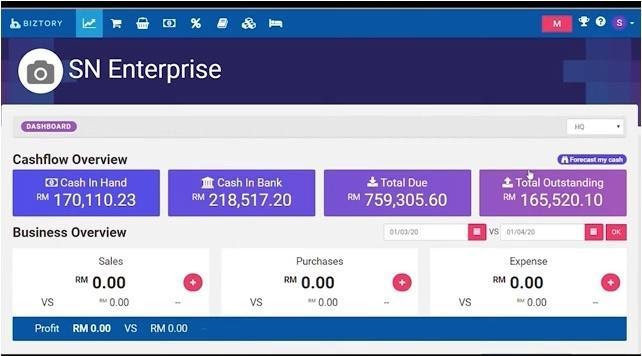

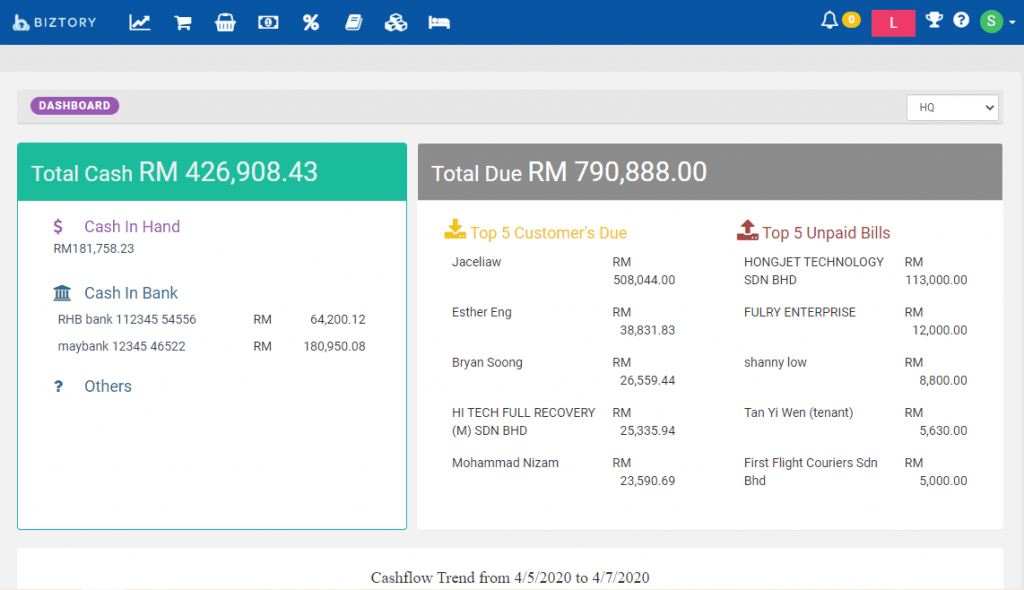

Biztory dashboard, giving an overview of your business cash flow

Not only can the Biztory app handle book-keeping, it can also issue purchase orders, invoices, input sales targets, track sales progress, manage inventory, and perform tax estimation. All these information can also be viewed real-time via Biztory’s user-friendly dashboard.

One app to automate all your accounting needs, and present financial and business performance to you without you having to do all the work, or hire additional accountants as you expand your business; Biztory gives you information you need at top accuracy and speed, at a fraction of a cost.

If you have questions about how Biztory can integrate with your existing e-commerce, worry no more as we have also recently integrated ecommerce plugins with SiteGiant, Easy Store, and Netshop. With these plugins, your e-commerce data can be synced with Biztory for a seamless and complete e-commerce journey.

Feel the freedom that comes with automation, give us a try with our 30-day free trial.