Contents

- What is Corporate Tax in Malaysia?

- Importance of Corporate Tax Submission in Malaysia

- When and How to Pay Corporate Tax in Malaysia?

- Malaysia Corporate Tax Deductions

- Deduction #1: Current year business losses

- Deduction #2: Prospecting expenditure / pre-operational business expenditure / permitted expenses under 60F or 60H

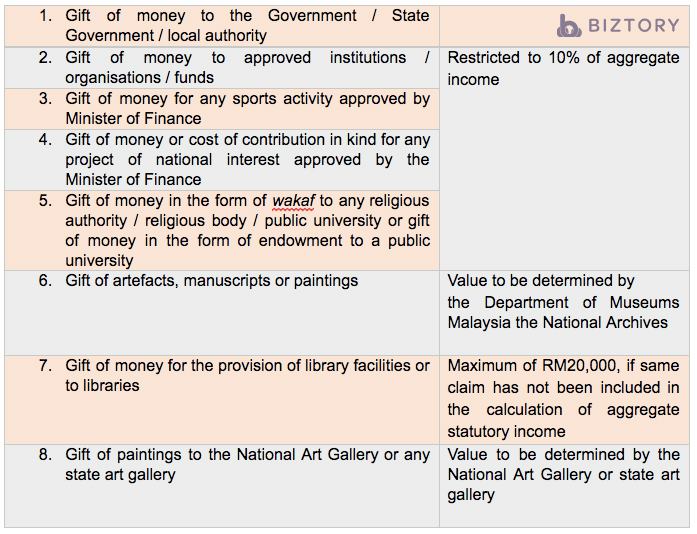

- Deduction #3: Approved donations / gifts / contributions

- Deduction #4: Zakat perniagaan

- Deduction #5: Claim for loss under Group Relief provision

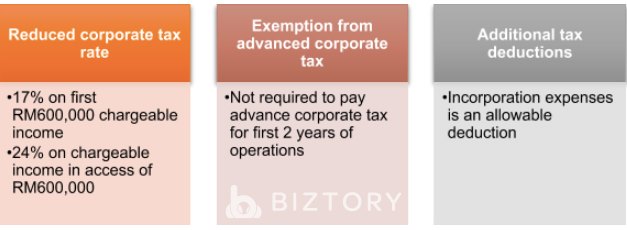

- Benefits of Being an SME in Malaysia

- Benefits of Knowing Taxation in Malaysia

- Biztory Tax Estimator

- Important Accounting Glossary

Having a business of your own grants you the freedom to be your own boss, execute your own ideas, work on passion projects, or develop products you are interested in.

Regardless of whatever motivations driving you to be a business owner, there are requirements that your business needs to comply with. One of such requirement is the need to pay corporate tax.

What is Corporate Tax in Malaysia?

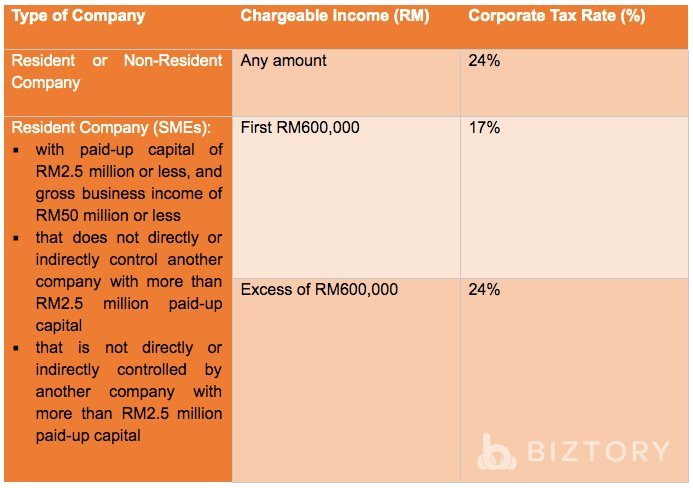

Corporate income tax, or corporate tax, is a direct tax that is paid to the government via IRBM/LHDN, it is governed under the Income Tax Act 1967. A corporate tax rate of 17% to 24% is imposed upon resident and non-resident companies on taxable income that is sourced from or obtained in Malaysia.

Although tax rates may vary based on yearly budget announcements, corporate income tax must be submitted and filed on a yearly basis, similar to an individual’s personal income tax. Different rates are applied to a company’s chargeable income based on the type of company. The following table shows the tax rates effective from year of assessment (YA) 2020:

Since corporate tax is only applied on income sourced from or obtained in Malaysia, foreign-sourced income is exempted from income tax unless your company is in the banking, insurance, air transport or shipping industry.

Who Needs to Pay Corporate Tax in Malaysia?

Corporate tax is applied on all registered companies, hence Sendirian Berhad and Berhad companies. Income from sole proprietorships and partnerships are reflected as individual business income and is to be respectively filed under Forms B and P.

Importance of Corporate Tax Submission in Malaysia

Taxes contribute to the growth of a country, which is why the Malaysian government has been pumping up initiatives to support the growth of SMEs in recent years.

The corporate tax rate has decreased from 40% in the late 1980’s to the current rate of 24%. Not only has the corporate tax rate been decreased over the years, the government has also given SMEs a special rate of 17% on the first RM500,000 chargeable income for YA 2019.

Following the Budget 2020 announcement in October 2019, the reduced rate of 17% is applicable to the first RM600,000 chargeable income in hopes that more Malaysians will get into businesses, and in turn contribute to the country’s growth.

Tax submission is also important to remain compliant with the law as corporate tax submission is required and governed by the Income Tax Act 1967. Any company that is registered with the Companies Commission Malaysia (a.k.a. Suruhanjaya Syarikat Malaysia, SSM) is required to pay corporate tax to avoid penalties for non-compliance with the tax law.

When and How to Pay Corporate Tax in Malaysia?

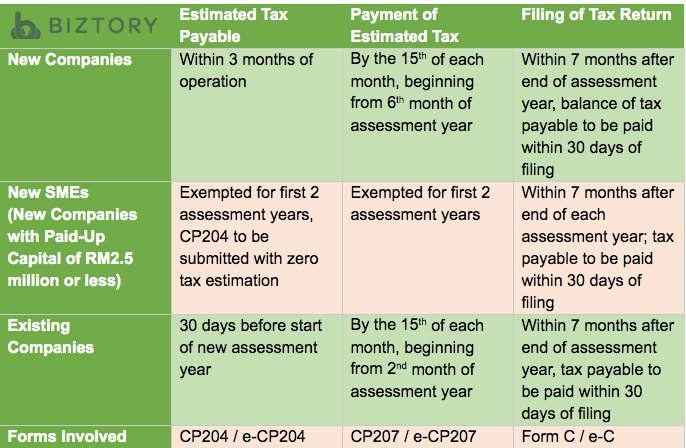

A registered company is required to submit an estimated tax payable before the start of a new assessment year, followed by tax payments in installments based on the estimated tax submitted. At the end of the assessment year, a tax return form must be submitted within 7 months.

The tax return form is filed to declare the company’s chargeable income and calculate the difference between the estimated and actual tax payable. If the estimated tax payable is higher than the actual tax payable, access tax paid will be refunded. If the estimated tax payable is lower than the actual tax payable, the company will pay the balance of tax payable.

The table below outlines the submission deadlines for the estimated tax payable and tax return forms. For SMEs, submission of estimated tax payable is exempted for the first two years!

Malaysia Corporate Tax Deductions

Within 7 months after the end of a company’s assessment year, Form C will be filed, tax repayable is made in 30 days, and advance tax paid in access will be returned. Much like personal income tax, corporate income tax is applied on a company’s chargeable income after applying tax deductions.

Tax deductions are business expenses incurred by the company for the sole purpose of gross income generation, and are deductible expenses allowed under provisions of the Income Tax Act 1967.

Chargeable income is derived by deducting outgoings and expenses such as:

Deduction #1: Current year business losses

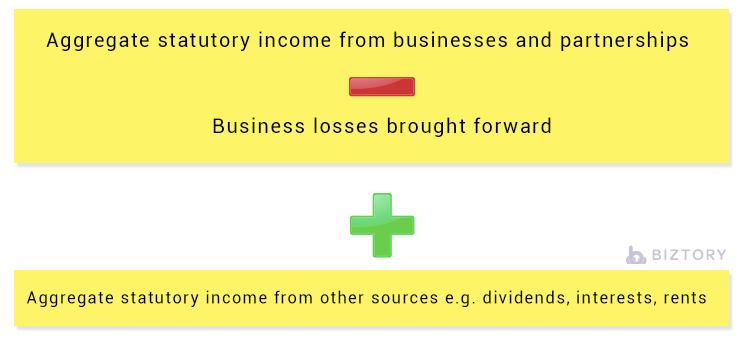

This amount is restricted to the aggregate income. Aggregate income is calculated like so,

If current year business loss is higher than aggregate income, the aggregate income is recorded for this deduction.

Deduction #2: Prospecting expenditure / pre-operational business expenditure / permitted expenses under 60F or 60H

A complete list of allowable deductions can be found in the Form C guidebook that is released for each assessment year. A sample of the 2020 guidebook for corporate income tax can be obtained from the LHDN website via this link.

A shortened list of allowable expenses is illustrated below. Another advantage of being an SME is that incorporation expenses are an allowable deduction once business commences!

| 1. Interest on money borrowed and used for production of gross income. |

| 2. Interest on money borrowed and used on assets used or held for the production of gross income. |

| 3. Rental expense of land or building occupied for production of gross income |

| 4. Bad debts proven irrecoverable and calculated into gross income |

| 5. Employer’s contribution to an approved scheme (up to 19% of employee’s contribution) |

| 6. Replanting expenditure |

| 7. Equipment, alteration or renovation of premises for disabled employees. |

| 8. Translation or publication of books in the national language, approved by Dewan Bahasa dan Pustaka |

| 9. Revenue expenditure on provision and maintenance of childcare centre for employees’ benefit |

| 10. Revenue expenditure by a company in obtaining certification in recognised quality system standard and halal certification (double deduction). |

| 11. Remuneration of disabled employees (double deduction). |

| 12. Freight charges for shipping goods from Sabah/Sarawak to Peninsular Malaysia (double deduction). |

| 13. Advertising expenditure on Malaysian brand/products. |

| 14. Promotional samples of products produced by a company. |

| 15. Approved expenses for the promotion of exports. |

| 16. Lease rental of motor vehicle. |

| 17. Entertainment expenses directly related to sales provided to customers, dealers or distributors (not suppliers). |

| 18. Entertainment expenses related to local leave passage to employee to facilitate yearly company event. |

| 19. Premium on fire insurance and loss of profit |

| 20. Incorporation expenses (for SMEs, or companies with an authorized capital of RM2.5 million or less) |

Deduction #3: Approved donations / gifts / contributions

Deduction #4: Zakat perniagaan

Maximum claim amount is 2.5% of the aggregate income

Deduction #5: Claim for loss under Group Relief provision

This deduction is only applicable if the company is claiming the loss from a surrendering company within the same group. A company may surrender up to 70% of its adjusted loss to another company within the same group.

For a more comprehensive understanding on corporate tax computation, please consult a professional such as those in RW William whom we are collaborating with on our tax module.

Benefits of Being an SME in Malaysia

Benefits of Knowing Taxation in Malaysia

As a business owner, understanding the allowable tax deductions allows you to make better plans for your company’s operations and cater to your employees’ wellbeing. Knowing which expenses qualify under deductible tax expenses also helps you to apply successful cost optimisation.

A business owner is also encouraged to have a general taxation knowledge especially regarding various types of taxes, deadlines, payments, and penalties involved such as the penalty imposed on an underestimation of tax payable by 30% or more. While this penalty was introduced to avoid companies from paying less in advanced taxes, it also creates a headache for small business owners who have no accounting knowledge and limited resources.

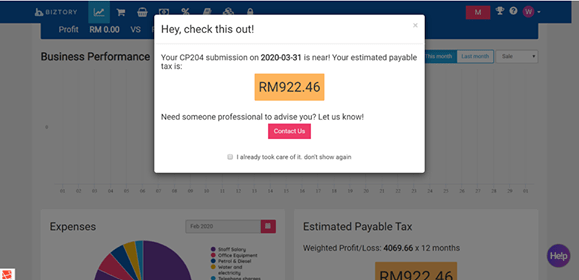

With these small business owners in mind, Biztory has recently launched a tax estimator module which is a built-in function of the existing Biztory cloud accounting app.

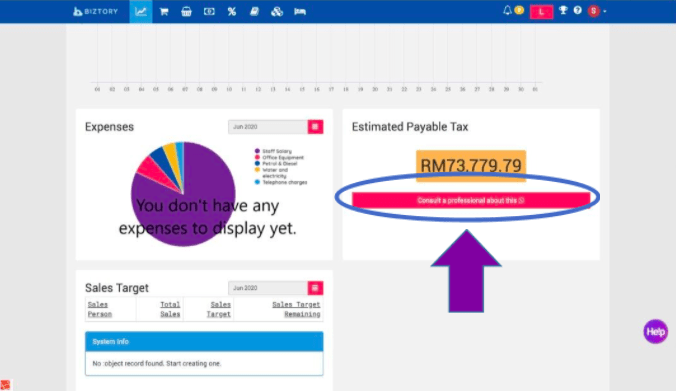

Biztory Tax Estimator

Biztory’s tax estimator module was created for Biztory users as a value-added feature on the cloud accounting software app.

By accessing the tax estimator module via the Biztory dashboard, Biztory users are able to understand their tax situation and obtain an up to date report on their estimated tax payable. The estimated tax payable is actively updated based on financial data that is captured within the Biztory cloud accounting app.

With this seamless approach, Biztory users no longer need to outsource this function to an external party, or pluck numbers from the sky because of limited resources to perform or outsource this function.

Biztory’s tax estimator module is also designed in collaboration with RW William, a chartered accounting firm. So Biztory users who access the tax estimator module are also given an option to reach out to professional accounting and tax consultants at RW William if they wish to understand their tax situation in a more detailed manner. Consultation is easy and made available at the click of a button.

Biztory combines cloud accounting and tax solutions in a user-friendly app that is easily accessible anywhere, anytime. What’s more, the tax estimator module is a free add-on to Biztory’s accounting app! That’s right, Biztory users will not need to pay any additional fee on top of the existing subscription fee to access the tax estimator module.

Could this be the tax solution you’ve always been looking for? Interested to get a first-hand experience of the tax estimator module? We welcome you to get a first-hand experience of Biztory’s tax estimator module or cloud accounting software for 30 days, free of charge! All you need to do is click here.

Important Accounting Glossary

Aggregate income: (Aggregate statutory income from businesses and partnerships minus Business losses brought forward) plus (Aggregate statutory income from other sources e.g. dividends, interests, rents).

Corporate tax: Also known as corporate income tax. It is a direct tax that is payable by companies to IRBM/LHDN on a yearly basis. A rate of 17% to 24% is applied on a company’s chargeable income.

Chargeable income: Aggregate income minus (Current year business losses plus Prospecting expenditure / pre-operational expenditure / permitted expenses under section 60F or 60H plus Approved donations/gifts/contributions plus Zakat perniagaan plus Claim for the loss under Group Relief provision).

CP204: Form used to submit estimated tax payable.

CP207: Form used to make monthly installments on estimated tax payable.

Estimated tax payable: Estimated tax that is submitted in advance, before a new assessment year.

Form C: Tax return form that is filed by companies within 7 months after the end of an assessment year.

IRBM: Inland Revenue Board of Malaysia

LHDN: Lembaga Hasil Dalam Negeri

Taxable income: Business profit, dividend, interest, rent, royalty, premium or other earnings.

Resident company: Company that has at least one of its board meetings held in Malaysia to discuss its management and control, or the company exercises its management and control in Malaysia.

YA: Year of Assessment