Contents

- How to Do Bank Reconciliation?

- How To Do Bank Reconciliation With Biztory?

- Bank Reconciliation Problems

- Bank Reconciliation Example

- Bank Reconciliation Statement

- What Is the Purpose of Bank Reconciliation?

- Get Biztory M Plan 30-Day Free Trial Account With Hong Leong Bank

- How To Activate Hong Leong Bank Auto Bank Reconciliation?

A bank reconciliation is a document that compares the cash balance on the balance sheet of a company with the amount on its bank statement. The reconciliation of these two accounts assists in deciding if accounting adjustments are required.

Bank reconciliations are done at regular intervals to assure the cash records of the organization are recorded accurately. It is also mainly done to detect any fraud cases or money manipulations happening to the account.

Otherwise, cash balances can be different than expected, which leads to bounced checks or overdraft fees. Many forms of fraud can be identified by doing bank reconciliation. This information can be used to implement stricter controls on cash receipt and payment.

Some businesses do their bookkeeping themselves, while others hire bookkeeping services to do bank reconciliation. You only need to reconcile bank statements if you use the accounting accrual process. Otherwise, if you use cash accounting, every transaction is reported at the same time as the bank does; there would be no inaccuracy between your account records and your bank statement.

For big businesses, they have full-time accountants to make sure and match all accounts coming in and out. As for small business, this duty is typically done by the owner’s own responsibility, or as mentioned, they would hire someone to do the bookkeeping process.

There are several reasons why differences tend to occur between the bank statement and accounting record by the company:

- Deposits in transit: Cash and checks received and reported by the company but not yet recorded in the bank statement.

- Outstanding checks: Checks given to creditors by the company but the payments have not yet been processed.

- Bank service fees: Fees charged by the bank for the services they offer to customers.

- Interest income: Banks pay interest on bank accounts.

- Not sufficient funds (NSF) checks: This happens when a customer deposits a check into an account but the check issuer’s account has an insufficient balance to pay the fee. Individuals or businesses that attempt to cash an NSF check will be charged a processing fee from the bank. The check will be returned as NSF check to the depositor.

How to Do Bank Reconciliation?

When you do bank reconciliation, you must find that your accounts and your bank account are not in sync with the transactions made. There are several steps you must follow in order to do bank reconciliation.

But first, you have to make sure that your books and accounts are up to date. They must be put in order for the bank reconciliation to systematically work.

Below is the step-by-step bank reconciliation process you can follow:

1. Get bank records

You’ll need the list of bank transactions. You can get it from a receipt, from online banking, or directly to your accounting software by requesting the bank to send the data. If you have a current account and credit card account that is active, both statements will be needed for this first step.

2. Gather business records

Next, you need to open your income ledger and other outgoing records. It can be in the form of spreadsheet, logbook or through accounting software.

3. Start from where you stopped

Find the last time your company books balance was the same as your bank account balance. From there, you can begin the reconciliation.

4. Check the bank deposits

Make sure every deposit in your accounts appears as income. Once you discover a deposit is missing, don’t forget to include it. You’re going to have to find out whether it’s a sale, interest, refund or other issues.

5. Go through the income in your records

Every entry on your bank statement should match as a deposit. If something is missing, you need to find out why. It could be a customer payment that has been bounced.

6. Check the bank withdrawals

You will record all bank withdrawals in your accounts. This covers details such as bank fees, which you may not have yet accounted for.

7. Run through the recorded expenses

Each entry on your bank statement will fit with a withdrawal. If they don’t, you have to find out why. You may not have cleared one of your payments yet, or you may have paid out using cash or another account.

8. Adjusted end balance

Once all the deposits and withdrawals have been checked, your company’s bank balance will match the balances in your business accounts. This will be the starting point for your upcoming reconciliation.

How To Do Bank Reconciliation With Biztory?

When you receive the bank statement for your company’s bank account, you usually will check that the bank details match with your account records for proper book-keeping sake. Here is how you can do bank reconciliation with Biztory:

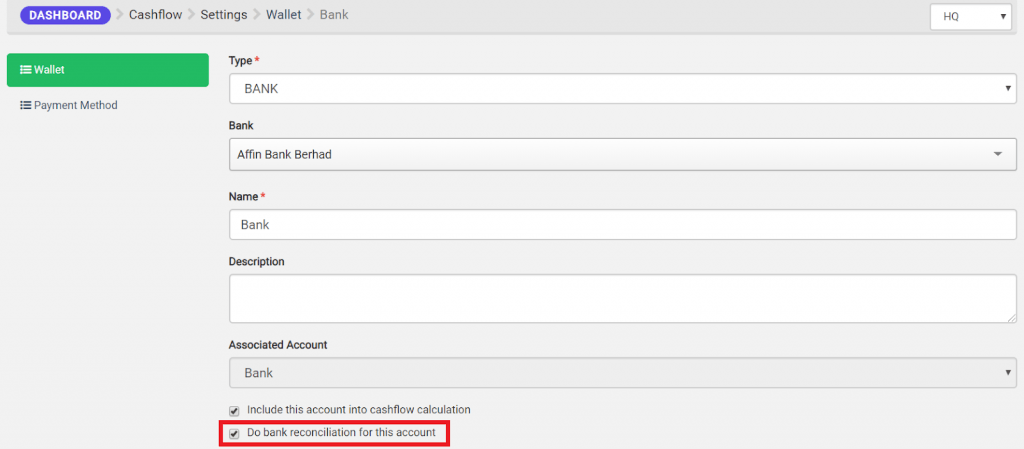

1. First, you need to set up which accounts you wish to reconcile.

Go to Cashflow > Wallet from the main menu and choose to edit an account. Tick the checkbox “Do bank reconciliation for this account”.

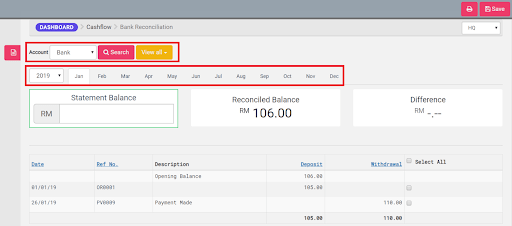

2. Now you can start doing bank reconciliation by going to Cashflow > Bank Reconciliation

3. You need to select a statement date and an account to reconcile.

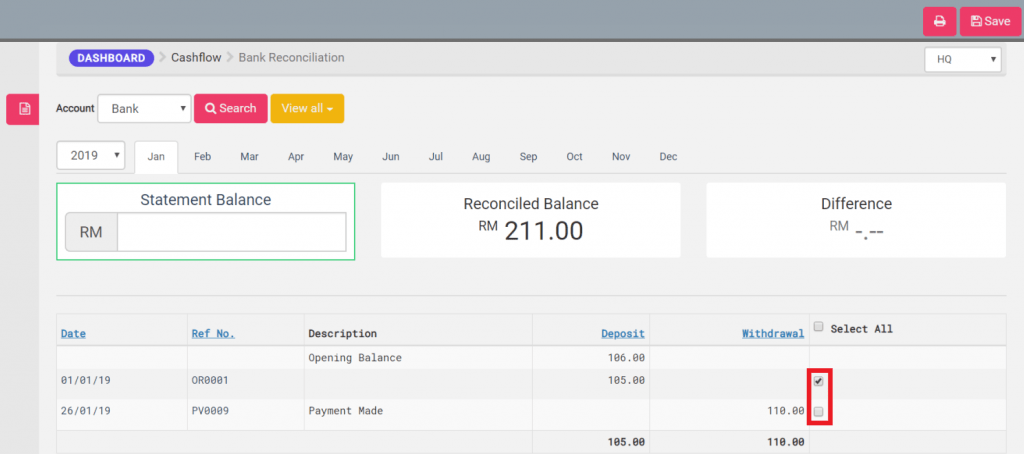

4. Now you can compare your Bank Statement details with the system’s records. Tick the checkbox to mark a record as reconciled.

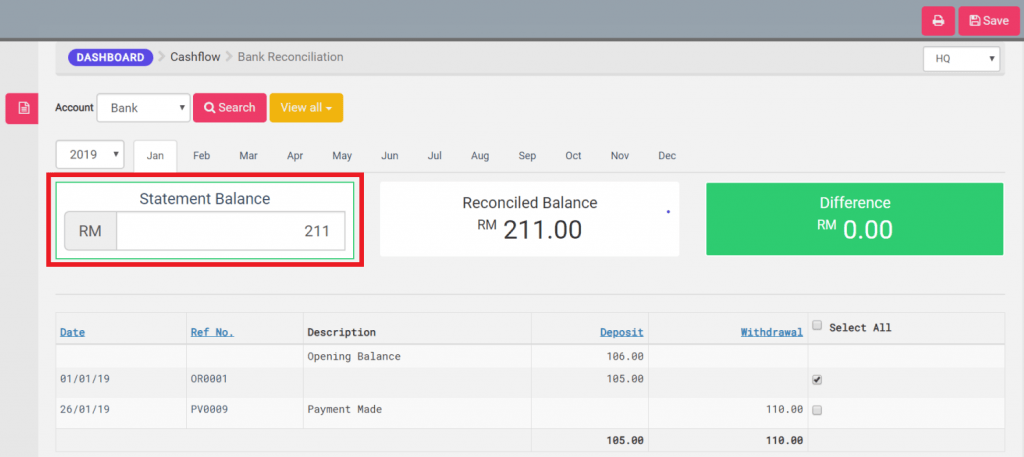

5. Under the account records table shows your account balance in the system after reconciliation. You should key in statement balance (as stated in your Bank Statement) here to see the difference between the two. Note: A proper bank reconciliation should always result in zero difference.

6. Hit the Save button to save all changes.

7. You will most probably encounter some records that are not booked in the system which results in a difference the Statement Balance and System Balance. These records usually consist of bank charges and bank interest. You can create Expenses for bank charges and/or create Journals for bank interest to make the system balance tally with your bank statement. Don’t forget to reconcile these records too.

8. Lastly, you can print out a Bank Reconciliation report.

Bank Reconciliation Problems

There are a number of problems when it comes to bank reconciliation, they are as follows:

1. Uncleared checks which are still not addressed/presented

There would be a small number of checks that are either not submitted for a long time to the bank for payment, or that are never submitted for payment. In the short term, you will handle them in the same way as any other uncleared checks by keeping them listed in your accounting software in the uncleared checks, so they will be an ongoing reconciling element.

However, for the long run, you have to contact the payee and see if they’ve ever received the check; you’ll possibly need to cancel the old check and issue a new one.

2. Checks clear the bank after having been voided

If a check is left uncleared for a long time, you are likely to void the old check and issue a replacement check. What if the payee is cashing the original check? The bank will deny the check when you voided it.

If you have not voided it with the bank, then you will have to record the check with a credit to the cash account and a debit to signify the reason for payment. If the payee has not cashed the replacement check yet, you need to immediately cancel it with the bank to prevent a double bill. Otherwise, you’ll need to seek second check repayment with the payee.

3. Returned checks

There are situations in which the bank refuses to deposit a check, usually because it is drawn on another country’s bank account. To solve this, you must reverse the initial deposit transaction, which would be a credit to the cash account with a corresponding debit in the receivable account.

Bank Reconciliation Example

Jenny Enterprise is closing its books for the month ending June 30. The controller at the company must prepare a bank reconciliation based on these issues:

1. The bank statement contains an ending bank balance of RM200,000

2. The bank statement contains an RM150 check printing charge for new checks that the company ordered

3. The bank statement contains RM90 service charges for operating the bank account

4. The bank statement rejects a deposit values RM450 due to not sufficient funds, and charges the company RM50 fee associated with the rejection

5. The bank statement contains interest income of RM60

6. Jenny Enterprise issued RM50,000 of checks that have not yet cleared the bank

7. Jenny Enterprise deposited RM25,000 of checks at month-end that were not deposited in time to appear on the bank statement

Below is the reconciliation:

| item | Adjustment to books | ||

| Bank balance | RM2,000.00 | 1 | |

| – Check printing service | – 150 | 2 | Debit expense, credit cash |

| – Service charge | – 90 | 3 | Debit expense, credit cash |

| – NSF fee | – 50 | 4 | Debit expense, credit cash |

| – NSF deposit rejected | – 450 | 5 | Debit expense, credit cash |

| + Interest income | + 30 | 6 | Debit cash, credit interest income |

| – Uncleared checks | – 50,000 | 7 | None |

| + Deposit in transit | + 25,000 | 8 | None |

| Book balance | RM174,290 |

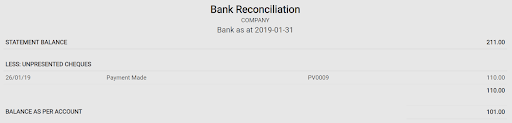

Bank Reconciliation Statement

Upon completion of the bank reconciliation process, you will be able to print a report from your accounting program that displays the bank and book balances, the gaps found between the two (mostly uncleared checks), and any remaining unreconciled gaps.

Keep a copy of this report every month. The auditors would like to see this as part of their audit year-end. Document format can differ by software; a simplified layout is:

| Bank Reconciliation Statement For Month Ended June 30, 2020 | Notes | |

| Bank balance | RM500,000 | |

| -) Checks outstanding | – 150,000 | See detail |

| +) Deposits in transit | + 50,000 | See details |

| +/- Other adjustments | 0 | |

| Book balance | RM400,000 | |

| Unreconciled difference | RM0 |

What Is the Purpose of Bank Reconciliation?

- To detect errors like double payments, missing payments, mistakes in calculations and more.

- To detect fraudulent transactions

- To keep accounts payable and receivables of the business on track

- To track and add bank fees and penalties in the record

It is advisable for you to do bank reconciliation often on a scheduled basis. If you missed it out for a longer time, the more hassle you will have to face. It’s not because you have more transactions to do, but the process to go through per transaction will be longer as you’re going to have a difficult time to recall the details.

Commit to schedule the time each week or even better, every day. Set up a system that allows you to find the records you need quickly and easily.

Get Biztory M Plan 30-Day Free Trial Account With Hong Leong Bank

Good news to Hong Leong Bank customers! You can now use Biztory cloud accounting software to manage your business cash flows and invoices conveniently. This 30-day free trial promotion is only valid for new customers.

Here’s why you should sign up:

1. Automated bank reconciliation

Biztory auto-sync with your Hong Leong Bank ConnectFirst account to update you on the real-time cash flow status from time to time to save more of your time.

2. Generate payment file

Instead of paying off your company expenses one by one using Biztory, you can now pay it all at once. You may do so by downloading the files and upload them to Hong Leong Bank ConnectFirst, and pay all in one click.

3. Get paid instantly with FastCollect

Getting on board as a JomPAY Biller is easier by signing up for HL ConnectFirst FastCollect via Biztory. Enjoy JomPAY transactions and charge waivers whenever your customers make payment to you.

Biztory gets your invoicing and accounting on cloud, so that you can manage it anywhere, anytime. It is designed to be user-friendly, even without accounting knowledge, you can still manage the business accounting.

Hong Leong ConnectFirst presents your business the gift of efficiency and convenience, with comprehensive solutions designed to keep your business running smoothly. It also helps you manage your business cash management effectively and efficiently.

How To Activate Hong Leong Bank Auto Bank Reconciliation?

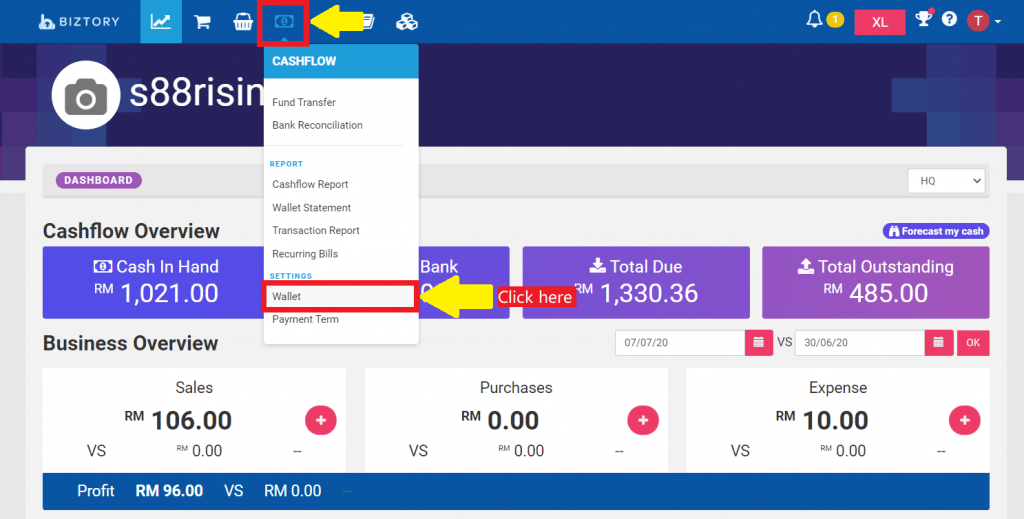

1. Login into your Biztory account.

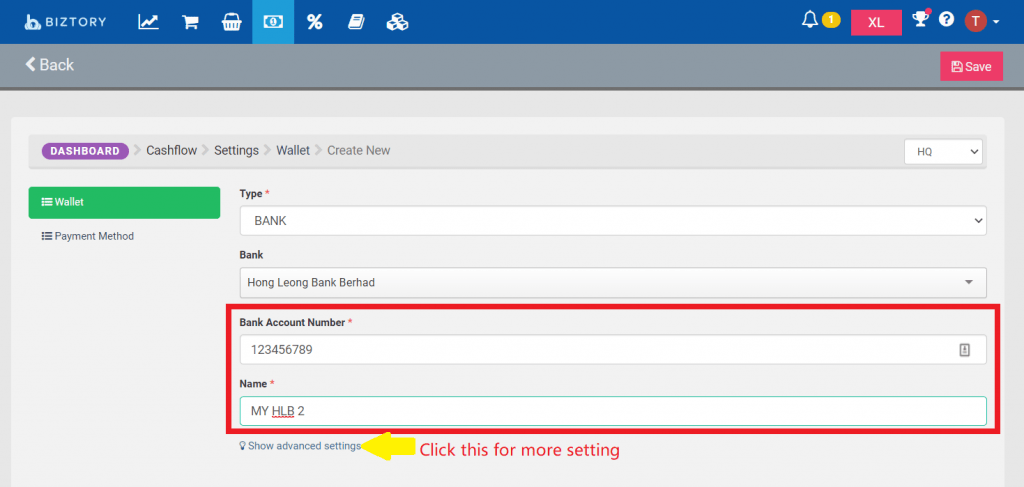

2. Go to Wallet to set a bank account.

3. Click “Add New” to add your Hong Leong bank account into the Biztory system.

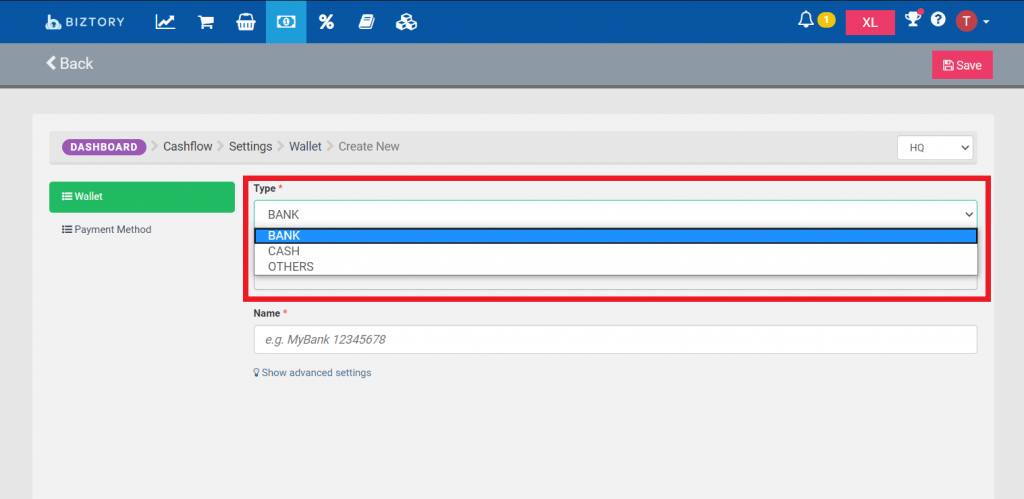

4. Choose “Bank”

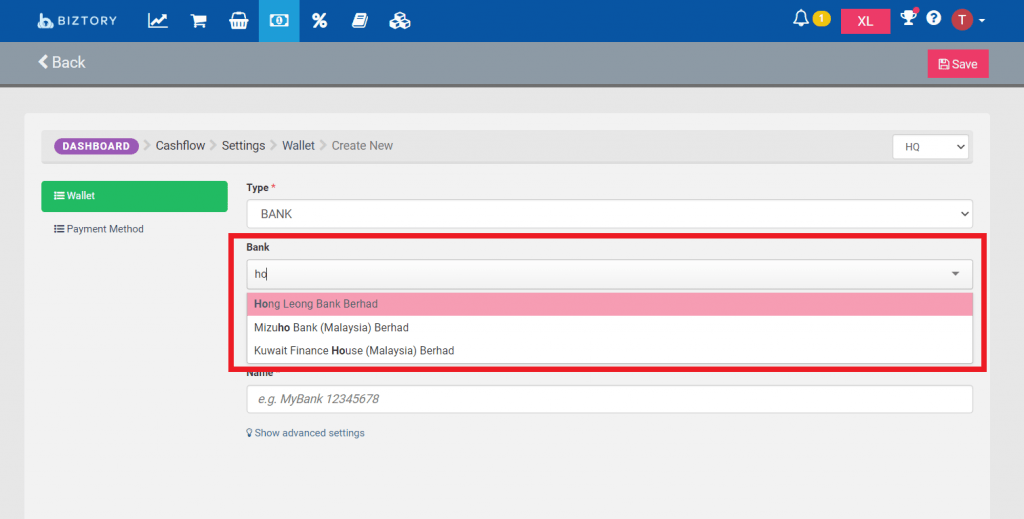

5. Choose “Hong Leong Bank”

6. Key in your bank account number to sync Biztory and Hong Leong Bank and set a name for this “wallet”. After that, click “show advanced setting” to add more advanced setting.

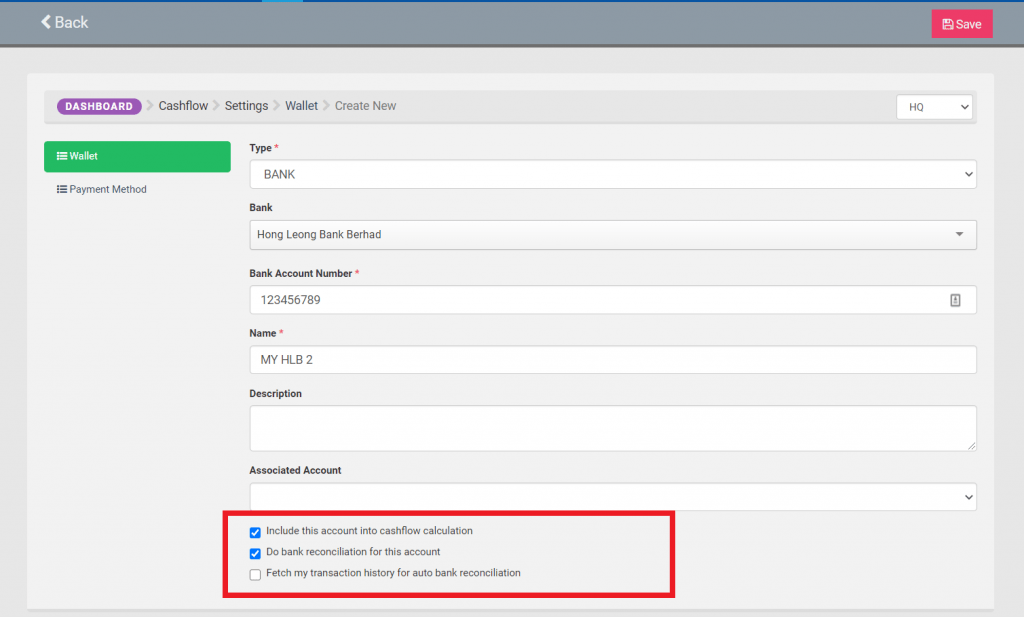

7. Tick the last column.

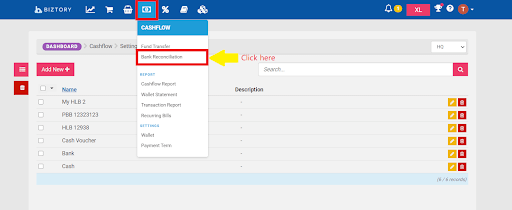

8. Go to “Cashflow” find “Bank Reconciliation”

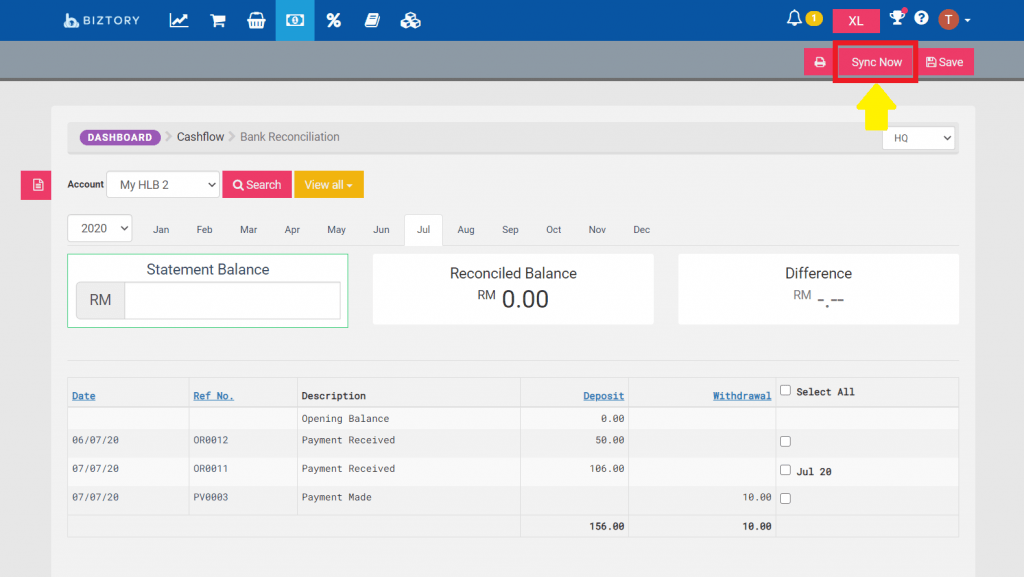

9. Click “Sync Now”

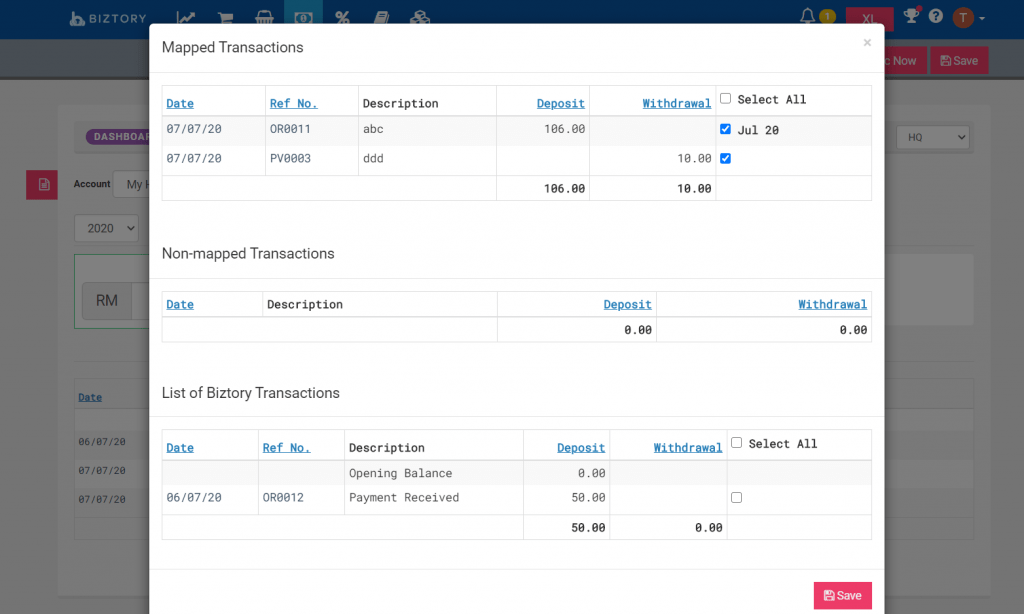

10. Mapped Transaction: Biztory automatically helps you to match the Biztory transaction with the bank transaction by the date and amount.

Non-Mapped Transaction – There is no recorded transaction in Biztory, but the bank statement has the transaction. (eg. bank charges, or other personal expenses of the card owner) You should create the expenses so that the transaction can be matched.

List of Biztory – The transactions have key in into Biztory (eg. Expenses, Bill paid or Payment collected), but bank statement do not have the recorded transaction. You should double check the transaction to ensure that the bank details are correct.

You can do checking and tick (match) or untick (unmatch) the transactions if the matching is inappropriate.

You should make sure the transactions key into Biztory do not duplicate and the details of transactions are right.

11. Save it after checking and make sure everything matches.

What are the benefits of Hong Leong Bank auto bank reconciliation?

- You can save up a lot of time.

- Reduce human error.

- You can make sure the transaction is right.